A stalwart of the decentralized finance community, Curve Finance was launched in January 2020 to serve as a decentralized exchange liquidity pool for stablecoin exchanges. The protocol provides extremely efficient stablecoin trading. In addition to maintaining low fees and low slippage through using a powerful yet elegant bonding curve, the exchange of tokens is made extremely efficient by only accommodating liquidity pools consisting of similarly behaving assets. This article will give you an in-depth look at the Curve Finance ecosystem.

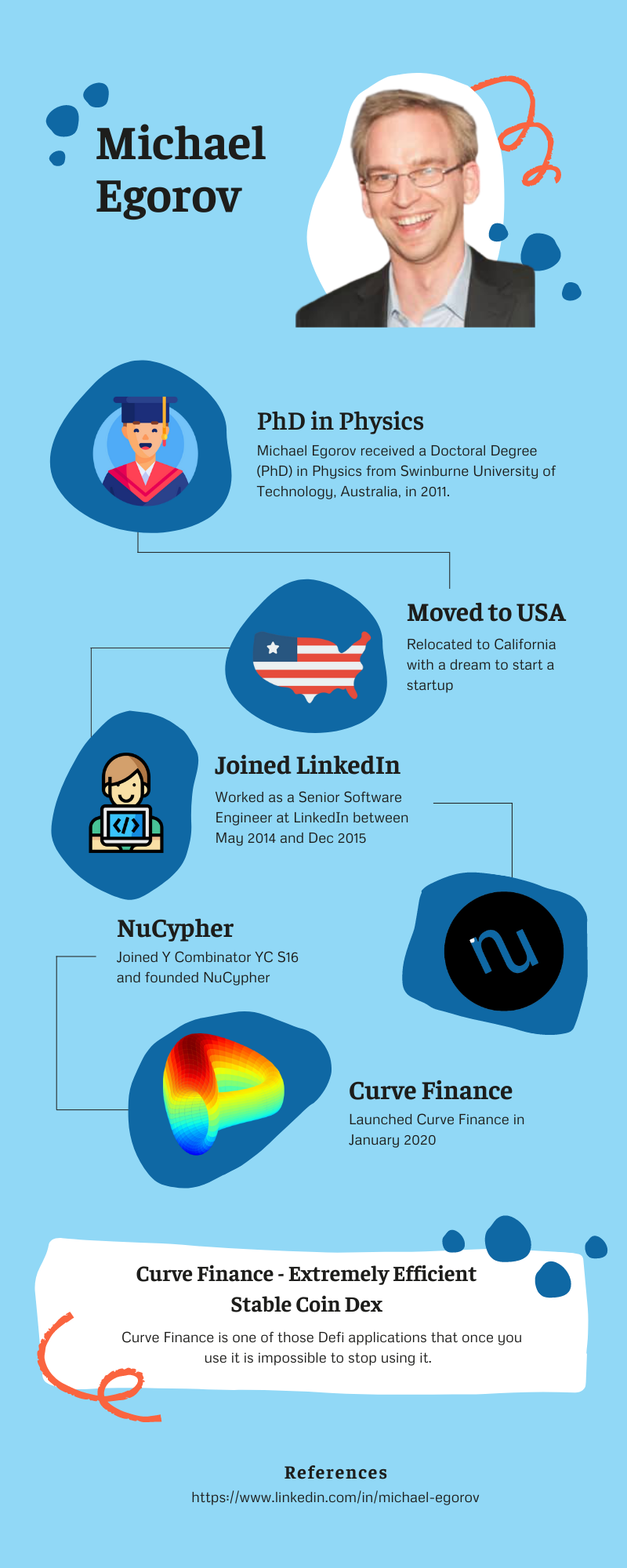

Humble Journey of Michael Egorov, Founder of Curve Finance

The humble beginnings of Michael Egorov, founder of Curve Finance, are the starting point for our deep dive. Michael Egorov graduated from an Australian university with a PhD in Physics. After moving to the United States, he stumbled upon bitcoin around 2013. During his time working as a software engineer, he discovered Defi through the MakerDAO project and began building trading bots. He soon realized how difficult it was to exchange stablecoins like DAI with USDT and USDC on Coinbase and other crypto exchanges. His expertise in abstraction and developing intuitions in physics helped him to author a brilliant white paper for Curve Finance and to introduce the Bonded Curves for stablecoins. This infographic shows Michael Egorov’s humble beginnings in founding Curve Finance.

How Curve Finance Works?

Curve finance, based on Ethereum blockchain, is a decentralized exchange that provides efficient trading between cryptocurrencies of similar value. Curve finance is the goto DEX for swapping stable coins (DAI, USDC, USDT) and similar value pairs like ETH & WETH, BTC & renBTC etc. In addition, Curve offers high return opportunities to liquidity providers who deposit cryptocurrencies into Curve liquidity pools to facilitate automated market making. Unlike Uniswap liquidity providers experience very less impermanent loss as all the pools hold similar value tokens.

Bonding Curve

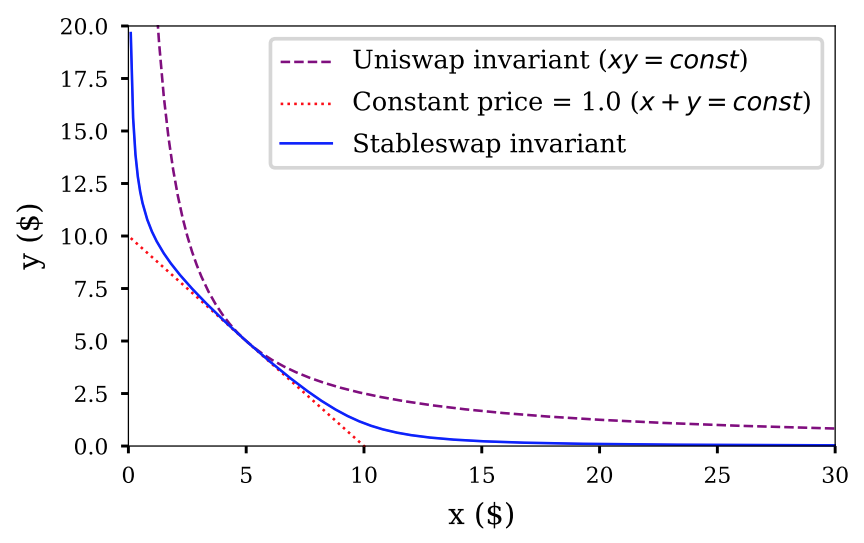

Bonding curves are mathematical concepts used to describe the relationship between price and supply of a financial asset. The bonding curve used by Curve Finance is unique, as it is designed to squeeze the price into a narrower margin as stablecoins are generally priced around 1.0 USD or 1 GBP or 1 ETH = 1 WETH. The diagram below from Curve Finance whitepaper shows the uniqueness of its bonding curve when compared to Uniswap invariant curve and constant price curve. It shows how two cryptocurrencies (X & Y) with five coins each priced at 1.0 fits in the curve.

Curve Finance Bonded Curve allows more flexibility in the ratio between the stablecoins in the pool and effectively prevents the slippage of prices. The diagram below shows just how much smaller the slippage is when compared to Uniswap’s curve.

Types of Curve Liquidity Pools

Below are the different types of liquidity pools available for Curve Finance Liquidity Providers

Plain Pools/ TriPools: TriPools are the biggest pools on Curve Finance, and they are non-lending gas optimized pools. These pools hold three crypto currencies (ex: USDC, DAI & USDT) to facilitate swaps among these currencies.

Lending Pools: Lending pools earn interest by lending tokens deposited in them on lending protocols like Compound, Aave, yEarn. These pools can better perform while lending rates are high and help generating more interest rates for liquidity providers.

Bitcoin / Ethereum Pools: These pools facilitate trades between pairs like wBTC & renBTC and wETH and stkETH. They work like stablecoin pools as they allow trading between similar value tokens (1 Ethereum token = 1 staked Ethereum token)

Factory Pools: Factory pools are permissionless pools that anyone can deploy on Curve. Though there no preliminary vetting from Curve for any of the assets in these pools is required, they are not listed on Curve’s home page unless they satisfy the following criteria

- At least one audit

- Market cap of at least $3m

- Fortnightly volume over $3m

- Pool liquidity over $500k in 3CRV

Curve Finance Metrics

Let’s take a deeper look at The Curve Finance metrics and see the total locked value and the daily transaction volume.

TVL (total value lock) is the one of the most popular metrics used for measuring performance of a DeFi(Decentralized Finance) applications. TVL represents the total amount of money, mostly measure in US Dollars, in a DeFi applications smart contracts. The term “locked” can be deceiving as there aren’t any assets locked in any specific amount of time in many Defi apps. TLV simply measures the amount of secured assets by a Defi application.

As I draft this article on Sep 15th, the total amount of money locked in Curve Finance is around 12.5 billion US Dollars. Below is a chart that illustrates the total value of Curve since its inception. The maximum locked value of 12.95B was observed on September 5, 2021.

This chart shows the week-over-week change in Curve Finance’s total value locked. While most of the weeks we see TVL gain in growth, the May flash crash resulted in the largest weekly decline. Maximum gain In TVL ($) of 2.16B was observed on May 30th – June 5th, 2021, and maximum drop in TVL ($) of -1.8B was observed in 16th – 22nd May 2021.

The chart below shows daily trading volume for Curve Finance starting Sep 18th 2020 through Sep 17th 2021. A maximum Volume ($) of 2.79B was observed on October 26, 2020, and a minimum Volume ($) of 1.77M was observed on September 29, 2020.

This bubble chart shows monthly transaction volume of Curve Finance. The Total Volume ($) between September 2020 to September 2021 was 64.86B. And if we look for months where we had maximum and minimum transactions volumes, May 2021 and Sep 2020 stands out. A Maximum Volume ($) of 11B was observed in May 2021 and minimum Volume ($) of 1.92B was observed in September 2020

This chart shows transaction volumes for each day of the week from Jan 2021 to Sep 2021. Does the day of the week affect transaction volume? Let’s examine it.

Curve Governance Token

CRV, an ERC-20 standard token, is Curve Finance’s governance token. Its purpose is to reward liquidity providers on the Curve Finance platform, as well as to involve as many Curve Finance users as possible in the protocol’s governance. Through a time-lock mechanism, Curve Finance rewards users who root for the growth of its ecosystem more than those who pump & dump or borrow tokens right before voting on governance proposals. Instead of giving each CRV token held by a wallet with one vote to cast, the number of votes are determined by the amount of time CRV tokens are staked. The user whose one CRV token has been locked for four years is credited with one vote; the user whose token has been locked for less time is credited with fewer voting power. Based on the amount of time the tokens are locked, here is the amount of voting power of a CRV token.

- CRV locked for 4 years = 1veCRV

- CRV locked for 3 years = 0.75veCRV

- CRV locked for 2 years = 0.50veCRV

- CRV locked for 1 year = 0.25veCRV

CRV token holders are shown in the chart below, and you’ll notice that as of September 17, 2021, 44.81K wallets own CRV tokens

The CRV token price trend from January 2021 to September 17 2021 is shown here. Total CRV prices for the year were $4.04 at the maximum and $1.16 at the minimum. Overall, we see the price of CRV tokens decreasing.

Curve Finance vs Uniswap – Curve Finance Is a Clear Winner!

Listening to podcasts and reading crypto blogs regularly might give you the impression that Uniswap is the most popular Distributed Exchange. Let me break that myth for you! Curve’s total value locked is almost double that of Uniswap’s. With a rearview mirror image of Uniswap, Curve Finance is distant first.

This chart shows the breakdown of TVL of Curve & Uniswap and the chart following shows daily trend comparison of TVL.

Closing Thoughts

In my view, Curve Finance is one of those DeFi apps that once you use it, you’ll never stop using it. It’s of tremendous value to both users looking to exchange tokens of similar value and liquidity providers seeking high returns without incurring permanent risk. Michael Egorov created an extremely efficient Distributed Exchange for DeFi users to swap tokens with minimum slippage and low fees using his bonding curve formula and a narrow focus on stable coins.

I’d recommend that Uniswap users who have never used Curve Finance before try it out. The user interface isn’t as attractive & clean as Uniswap’s, but don’t judge the book by its cover! Curve is the leading DeEx in crypto land.

References

The following is a list of websites, white papers, and data analytics platforms used to research information for this article.

- Flipside Crypto – https://www.flipsidecrypto.com

- Curve Finance – https://curve.fi

- Curve Finance White Paper – https://curve.fi/files/stableswap-paper.pdf

- Michael Egorov LinkedIn Profile – https://www.linkedin.com/in/michael-egorov

- Michael Egorov Twitter – https://twitter.com/newmichwill

- Messari – https://messari.io

- Defi Pulse – https://defipulse.com

- Coin Market Cap – https://coinmarketcap.com

- Dune Analytics – https://dune.xyz

- Icons used in infographic is by freepik, smashicons and eucalyp.