Anchor Finance is a savings protocol from Terra Blockchain and one of the hottest Defi applications in stable currency ecosystem. It offers a low-volatile high yields on Terra stable coin deposits. Wondering how high are yields? They are around 20% on US Dollar pegged stable coin, UST! While most of the traditional finance systems offering less than 0.5% of interest rate on Savings Accounts in USA, Anchor is offering 40x more yield!!

In this post let us understand how Anchor provides such high yields as well as explore historical interest rates with the help of FlipsideCrypto’s data.

How Anchor offers 20% Interest Rate?

Anchor allows borrowers borrow UST with over collateralized bonded assets (bLuna/bETH). Anchor protocol stakes these bonded assets and the returns from the staking are passed to depositors resulting in high yield. Here is a twitter thread from Do Kwon, the founder of Terra Blockchain, explaining how high yields are generated by Anchor Protocolo.

Historical Interest Rates

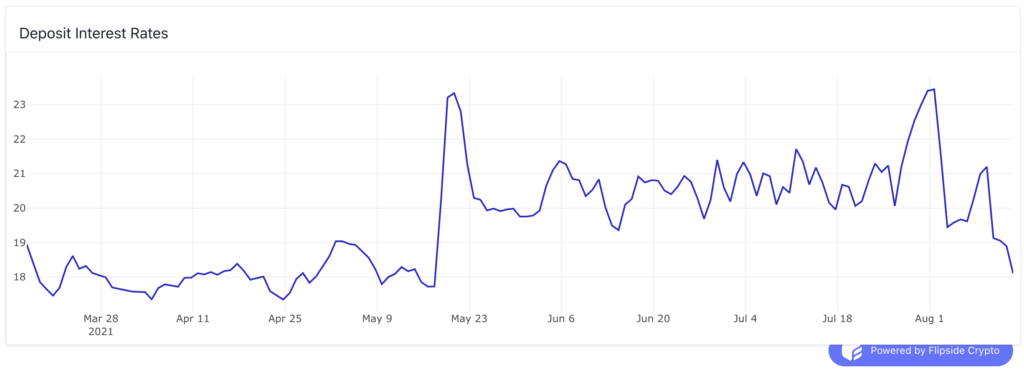

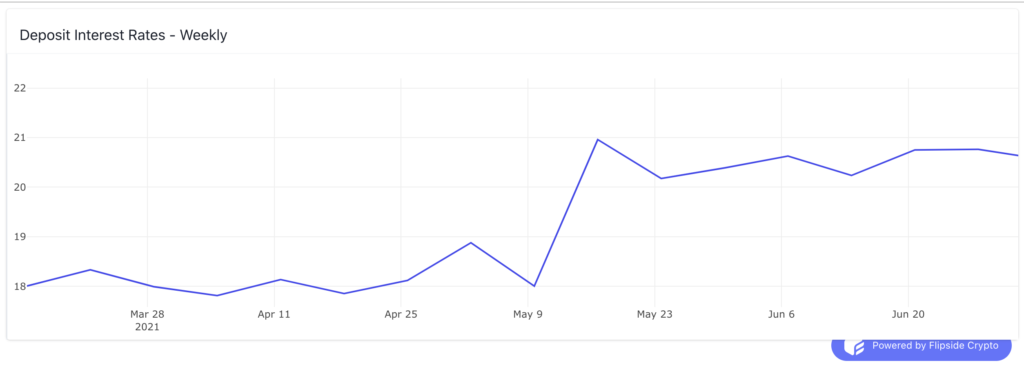

We can check how the tall claims of Anchor Protocol to offer 20% interest is actually working in action with the help of Flipside Crypto’s data. Here is a chart showing the historical interest rate offered to Depositors of Anchor protocol. As you see in the chart below, the depositors are actually getting very high interest rate and it is hovering around 18%-23% for the past months.

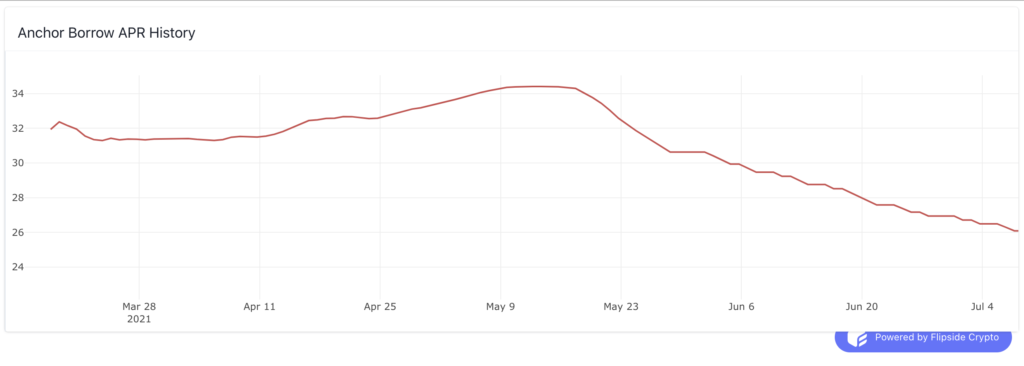

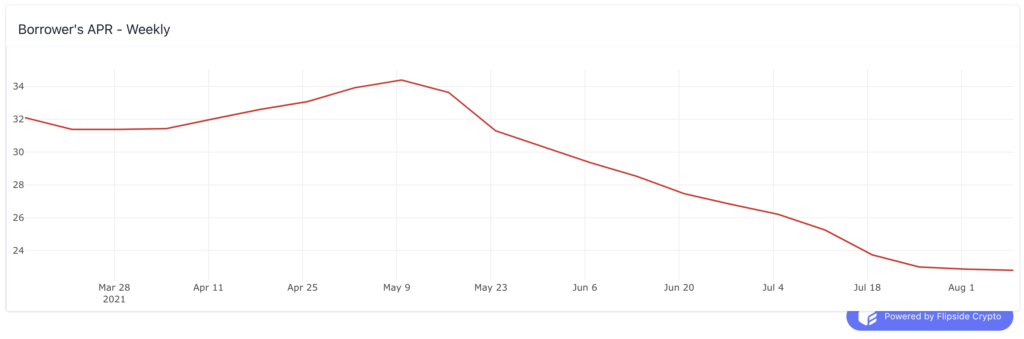

Now let us see how much borrowers are paying for borrowing UST on Anchor protocol in the chart below. We see that they are paying around 26% to 34% in the past 7 months. But why would one borrow UST at such rates?

The incentive for borrowers to pay such high APR is distribution of ANC tokens. ANC tokens, Anchor’s Governance Tokens, are distributed as incentive to borrowers proportionally to the amount borrowed. Anchor set aside 1 billion ANC tokens and 40% of them will be distributed in next 4 years to borrowers. As of today borrowers earn 48.34% APR of ANC for borrowing on Anchor!