Its always a painful thing to wait for the income tax refund, if we happen to invest more than what is required. Say for example, few of us would go for donation or charity which comes under 80G. Now a days 80G is not considered for Income Tax(IT) deductions in many of the Software service companies. Hence we have to claim tax refund for 80G related only when we file our IT returns for that financial year. So this becomes an excess money which would be returned by the IT department in the next financial year.

Checking The Refund Status

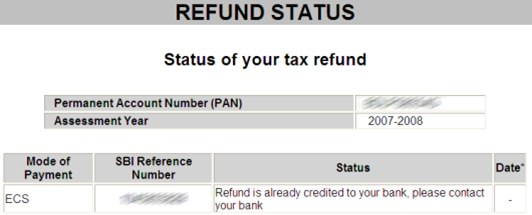

If you happened to pay more tax and waiting for the refund, Income Tax Departement of India has a website that provides the status of tax refunds. To know the status, point your web browser to https://tin.tin.nsdl.com/oltas/refundstatuslogin.html, enter your 10 digit PAN ID and select the financial year for which you want to the refuntd status.

Modes of Refund Payments

If you had opted for Electronic Clearing Service(ECS) mode of payment, your refund amount would be directly credited in your bank account details provided at the time of filing your IT returns. Otherwise you would receive a State Bank of India cheque.

Dear Sir,

I am Ravi Soni from Chittorgarh (Raj.), I don’t received my IT refund yet.

I have submitted My IT return of Assessment Year 2011-12 on 22.03.12

Filling Acknowledgment No. 359027220220312

My IT Ward No. ITO-COR730(03)

Please Do needful to issue my IT refund

Regards

RAVI SONI

S/o RAMESHWER LAL JI SONI

G/118/5 GANDHI NAGAR

CHITTORGARH

आदरणीय श्रीमान /श्रीमती

मेरा नाम सीमा सैनी है. मेरा वर्तमान पता फ्लैट नंबर ३ ,प्लाट नंबर बी-१४४, दादूदयाल नगर , कल्याणपुरा , सांगानेर जयपुर ३०२०२९ राजस्थान है.

मैंने अपनी INCOME TAX RETURN साल २०१०-२०११ की जयपुर की वार्ड संख्या ७ (२) में दिनांक १६-०७-२०१० को भुगतान की थी , जिसकी प्राप्ति संख्या २७२१००७३ थी .

जिसका की मुझे अभी तक T D S RETURN प्राप्त नहीं हुआ है . मैं वैयक्तिगत तरीके से दिनांक १३ सितम्बर २०११ से २० बार अधिकारी से मिल चुकी हूँ और वो मुझे हर दफा ७ दिन का समय दे कर वापिस भेज देते है . और हर बार मुझे एक ही लाइन बोलते है की आप की REQUEST हमने BANGLORE भेज दी है आप TDS RETURN ७ से १० दिन मैं आ जायेगा

उस के बाद मैंने INCOMETAX की हेल्प लाइन TEL NO ०१२४-२४३८०० पर बात की उन्होंने मुझे बोला की आप अपने ASSESSING OFFICER JAIPUR से जा कर मिलों . वंहा पर कोई सुनता नहीं है.

इस लिए मेरी आप से गुजारिश है की आप मेरा टी डी स वापसी दिलवाने का कष्ट करे . आप की अति कृपा होगी .

THANKS & REGARDS

SEEMA SAINI

9414026789

I have not recived my refunds for assmt.year 2007-08,2009-10&2010-11.but i have recived the 2008-09 refund on 01.09.09.Please do the needful and reply.V.A.Anthony.

DEAR SIR,Thanks for send my income tax refund cheque immediatly.any way this is very useful site.

Hi,

My tax return was filed online by one of the tax consultants for assement year 2010-11. My return was processed and the cheque was sent to my friend’s house (as I mentioned while filing). Now I’m in abroad and they did not know my name and did not accept the cheque. Now I have received an email from Income Tax department asking to update my PAN database address within 15 days. It would not be possible to send in 15 days (the letter, address proof, recent photographs have to be sent along with the letter). I am not able to reach the call center at all.

Please advise on what is the best approach to resend the checque to same address. I can tell my friend’s family about this now in advance.

Thanks,

Kavitha

I have filed my return for assessment year 2008-2009 through a tax lawyer at Lucknow till date I have not received my refund.

i filed my return for assessment year 2009-2010on line my pan is xxxxxxxx, but till now i haven’t received my refund

I am also trying to get the status of my 2009-2010 refund. I keep getting the message “Your assessing officer has not sent this refund to Refund Banker.”. I do not even know when I should expect it. I hear that the if the refund is delayed, then the IT department is supposed to give an interest of 18%.

I had to get a refund of Rs 6xxx(approx) in 2009-10 assessment year.then my cheque has been returned due to incorrect address could u plz guide me to know my refund status since https://tin.tin.nsdl.com/oltas/refundstatuslogin.html at this site the available financial yr is just upto 2007-08 so am not able get the status over there..kindly help me to know my status for the yr 2009-10…my PAN is xxxxxxxxxxx….

thanku

I had to get a refund of Rs 8xxx(approx) in 2008-09 assessment year. I came to know from the TIN-NSDL website that they have sent me a refund cheque but that is returned to them “Refund cheque returned undelivered by the postal department as address provided by you is incorrect”.

Could you please help me how I can get my refunds back at an early date?

Thanks a lot in advance.

get return status

Hi,

I filed my returns with this account who was introduced to through a friend.I got my refund for 2008 – 2009 before I go tmy refund for 2007-2008.However this account keeps telling me that I’ll get in the next mth & today he go tvery upset & tells me that he just submitted however its not upto him as to when I will be refunded.Says it might take a year or two or even more.When i checked online i also get the same msg that ‘Your assessing officer has not sent this refund to Refund Banker’.What does this mean.Pls advice as this guy i snot willing to help and has all my documents.

Hi

I have filed the IT returns for financial year 2008-2009 on Dec-2009, but havn’t yet recieved my refund.

when i do check the website for refund status, it shows “Your assessing officer has not sent this refund to Refund Banker”.

what does this mean ? that my tax was not filled or not in the site’s records.

Read more: http://www.techdreams.org/india/check-your-income-tax-refund-status-onlineindian-websites/1026-20090117#respond#ixzz0zZu5oItY

I have filed the IT returns for financial year 2008-2009 on july 2009. Still i didnt get any refund. I have choosen the refund option as ECS, plz suggest is there any online web address which i can know directly

I am also trying to get the status of my 2009-2010 refund. I keep getting the message “Your assessing officer has not sent this refund to Refund Banker.”. I do not even know when I should expect it. I hear that the if the refund is delayed, then the IT department is supposed to give an interest of 18%.

I have lost the acknowledgment for 2008-09 , and given the address of mumbai , now i reside in hyderabad.i have recieved refund for 2009-2010 thru a cheque.but not for 2008-2009 . can anyone give any forum or website or email address thru which i can check.

i haven’t received my refund yet. had filed returns july 2009.

I have filed the IT returns for financial year 2008-2009 on july 2009. Still i didnt get any refund. I have choosen the refund option as ECS, but i have failed to give the MICR code of the bank. To whom i have to contact, regarding this…